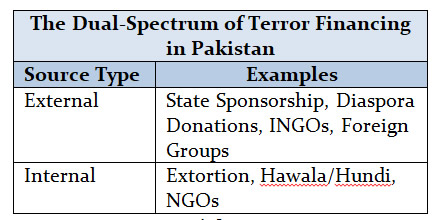

Terrorism financing (TF) involves providing funds to support terrorist activities. This funding enables the recruitment, planning, and execution of terrorist activities. Terrorism poses substantial risks to Pakistan’s national security and economic stability. Despite government efforts to disrupt terrorist networks, challenges persist due to a dual spectrum of illegal financing: external inflows from foreign actors and internal revenue generation by domestic terror groups. This insight aims to analyze funding streams, associated challenges, and regulatory responses and recommends stronger countermeasures. Table 1 highlights the dual spectrum of TF in Pakistan.

Table 1: Dual-Spectrum of Terror Financing in Pakistan

Source: Extracted from various sources

State-sponsored funding remains a significant external source of TF in Pakistan. According to the

Ministry of Information and Broadcasting, Pakistan submitted a dossier to the United Nations (UN) in 2020,

highlighting that India was utilizing cross-border networks to fund Tehreek-e-Taliban Pakistan (TTP) and Baloch

terrorists. Furthermore, in April 2025, the DG ISPR presented what was termed ‘irrefutable evidence’ of Indian

financial and operational support to terrorist networks in Pakistan.

Moreover, Pakistan’s geostrategic location makes it more vulnerable. It is directly impacted by regional

instability, especially in neighboring Afghanistan, and remains exposed to transnational terror networks and

illicit financial flows. Its proximity to conflict zones and porous borders further complicates enforcement

against TF.

Additionally, the US-China rivalry places Pakistan in a delicate position. This dynamic intensifies external

interference, including attempts to destabilize Pakistan through hybrid warfare, proxy actors, and the

exploitation of TF networks. These networks often receive funding and support from various state and non-state

actors seeking to advance their strategic interests, further complicating Pakistan’s security landscape and

efforts to maintain stability.

Illegal spectrum is closely linked to TF in Pakistan, as it enables covert communication that facilitates

untraceable financial transactions among terrorist networks. For instance, BLA has reportedly used illegal radio

frequencies in remote areas to coordinate attacks and distribute funds, with Pakistan conceding that India’s RAW

supports these activities. Similarly, intelligence reports presented by DG ISPR in 2024 revealed the use of

illegal spectrum by cross-border handlers directing financial transactions to BLA and TTP.

As per news reports, some madaris receive donations from the Pakistani diaspora communities and foreign

charitable/religious organizations for religious education, but the funds are redirected to support militant

activities. In 2015, under the National Action Plan (NAP), Pakistan froze over 200 bank accounts of unregistered

madaris to disrupt militant funding.

Additionally, funds from International Non-Governmental Organizations (INGOs) are sometimes diverted to extremist

groups. In February 2025, US Congressman Scott Perry claimed that USAID allocated $840 million to Pakistan’s

education over the last 20 years, including $136 million for 120 schools, with no evidence of their existence. He

also expressed concerns about funds being misused to support terrorism.

Foreign terrorist groups like Daesh and Al-Qaeda have financed operations in Pakistan through illicit channels. In

December 2023, Pakistan’s CTD arrested Jahanzeb, a member of a group financing Daesh, in Peshawar and recovered

23,500 Euros and Rs. 2.6 million.

Internal sources of TF include extortion money, also known as bhatta, and extortion from mines. These have adverse

effects on Pakistan's economy, society, and security. In KPK, 417 bhatta cases were reported between January and

October 2022, with various groups demanding an estimated Rs. 3.1 billion. Furthermore, in October 2024, armed

attackers assaulted coal workers in Balochistan's Dukki district, killing 20 people and destroying mining

equipment.

The extensive use of unofficial money transfer systems, such as Hawala and Hundi, is a significant barrier to

combating TF. In June 2020, Pakistani authorities arrested Haji Khairullah Barakzai who was involved in money

laundering through Hawala and Hundi operations to facilitate TF.

Terrorist groups often use NGOs as fronts to raise funds. In January 2023, US Congressman Michael McCaul raised

concerns regarding the Al-Khidmat Foundation, associated with Jamaat-e-Islami, and its links to Helping Hand for

Relief and Development (HHRD). Notwithstanding these concerns, HHRD continues to receive USAID grants despite

alleged terrorist links.

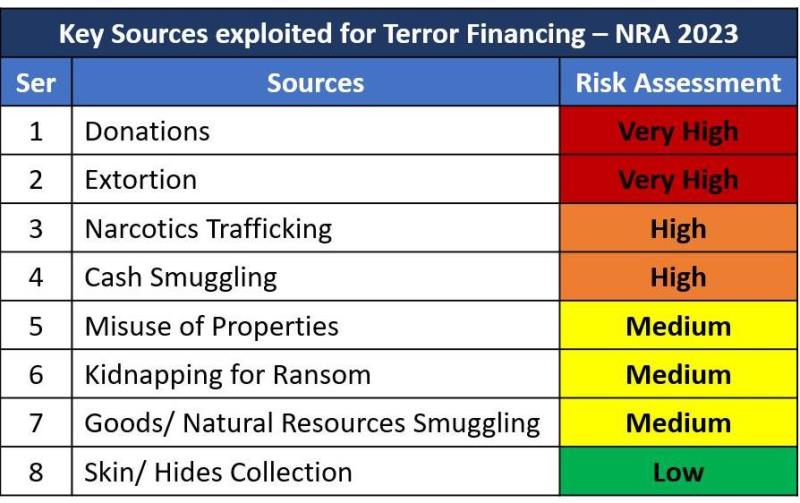

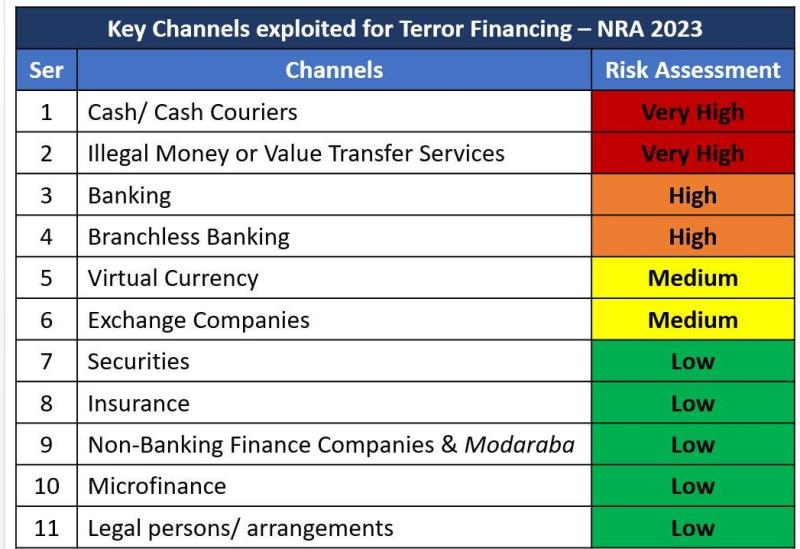

The National Financial Action Task Force (FATF) Secretariat of Pakistan finalized the National Risk Assessment in

2023. Table 2 provides a comprehensive analysis of the funding sources and channels used by terrorist groups.

Table 2: National Risk Assessment 2023

Source:National FATF Secretariat, Pakistan

In Pakistan, the Non-Profit Organizations (NPOs) industry is broad and diverse. National Counter Terrorism

Authority (NACTA) has banned numerous NPOs linked with TF, such as the Al-Rahmah Welfare Organization, Al-Furqan

Foundation Welfare Trust, Jamaat-ud-Dawa, and Falah-e-Insaniat Foundation. A comprehensive analysis revealed that

6.75% of NPOs were high-risk, 43.64% were medium-risk, and 49.61% were low-risk. Strict oversight procedures are

in place to prevent banned organizations from resurfacing. Provincial CTDs have established dedicated

Counter-terrorism Financing Units, supported by NACTA through coordination in areas such as TF, asset tracing, and

money laundering.

In 2020, Pakistan updated the Anti-Money Laundering Act to meet the standards of the Financial Action Task Force

(FATF), expanding the definition of money laundering, strengthening investigative powers, regulating non-financial

sectors, and increasing penalties. Also, Pakistan has established an inclusive framework, Anti-Money Laundering

and Combating the Financing of Terrorism (AML/CFT), to categorize, avert, and counter money laundering and TF

activities primarily through the Anti-Money Laundering Act and the Anti-Terrorism Act.

Pakistan's participation in the Asia-Pacific Group bolsters the effectiveness of its AML/CFT measures, thereby

reinforcing its commitment to adhering to international regulatory standards. In line with its obligations under

UN Security Council Resolution 1373, Pakistan has undertaken significant reforms to combat TF, including

strengthening legal frameworks and improving financial oversight mechanisms. These efforts contributed to its

removal from the FATF grey list in October 2022, reflecting tangible progress in aligning domestic policies with

international counter-terrorism standards.

However, the persistence of terrorist activity in Pakistan highlights a critical reality: internal reforms alone

cannot thoroughly neutralize the threat. A significant challenge lies in the continued influx of external funding

that sustains militant operations. One of the most concerning sources is state-sponsored TF. To effectively combat

external TF, it requires diplomatic, intelligence, and international legal interventions. Pakistan must actively

raise state-sponsored TF concerns at the UN, FATF, and other international forums, and build regional cooperation

to counter hostile financing networks. Despite diplomatic challenges, Pakistan must identify and name the

countries or their intelligence agencies, with proof, sponsoring terrorism in the country.

To achieve peace and security, Pakistan must continue refining its domestic counter-terrorism measures while actively confronting and exposing external sources of TF. This includes deeper diplomatic engagement, regional intelligence cooperation, and mobilizing international forums to hold state and non-state sponsors accountable.

The views expressed in this Insight are of the author(s) alone and do not necessarily reflect the policy of ISSRA/NDU.