Cross-border digital payments (CBDPs) are vital to global trade, remittances, and financial inclusion. With Pakistan's large diaspora and growing digital economy, optimising CBDPs presents challenges and opportunities. This Insight examines Pakistan’s CBDPs landscape, key hurdles, and growth prospects.

CBDPs are crucial for Pakistan for several reasons. Firstly, boosting exports is essential for sustained economic growth. Higher exports generate foreign exchange and often lead to an increase in imports. Secondly, remittances from expatriate Pakistanis are vital for stabilising the economy, as they provide a steady inflow of foreign currency. Furthermore, investments by expatriates and other foreign stakeholders, particularly in small and medium enterprises, play a key role in fostering economic growth, driving innovation, and creating employment opportunities.

Pakistan’s cross-border transactions primarily depend on traditional banks and Money Transfer Operators (MTOs) like Western Union and MoneyGram. Mobile wallets and fintech platforms like JazzCash and Nayapay ease domestic transactions, but cross-border transfers remain costly and inefficient.

Countries worldwide are advancing digital payment ecosystems, with Singapore in the lead. The cornerstone of Singapore’s success is its Fast and Secure Transfers (FAST) system, providing near-instant domestic fund transfers.

The International Monetary Fund (IMF) estimated (2021) that FAST contributed 0.5%–1.5% to Singapore’s annual GDP growth. The Singapore Fintech Association (SFA) reported (2022) a 20% yearly growth in Singapore’s digital payment market, driven by FAST.

Recently, Pakistan has improved its digital payment ecosystem, particularly for cross-border transactions, to enhance remittances and international trade. A key development is the launch of RAAST ID, an instant payment system by the State Bank of Pakistan (SBP), which primarily caters to domestic transactions but sets the foundation for future international integration.

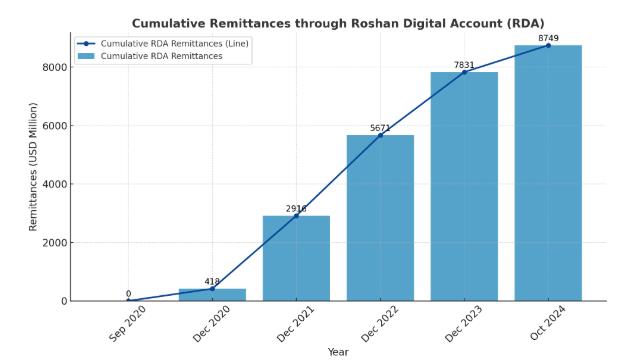

The SBP has launched the Roshan Digital Account (RDA) for non-resident Pakistanis to manage their accounts from abroad. It allows secure investments in Pakistan’s real estate, stock market, and government securities and facilitates tax-free remittances. The graph shows cumulative remittances through RDA over the last five years.

The graph illustrates a steady upward trend in cumulative remittances through the RDA from September 2020 to October 2024, increasing from zero to US$8,749 million. The period from 2020 to 2022 saw rapid growth, driven by strong early adoption, policy incentives, and increased trust among overseas Pakistanis. While remittances continued to rise, the growth rate began to slow after 2023, suggesting market maturity and potential saturation. Despite this, the RDA has maintained its role as a reliable remittance channel.

Similarly, Pakistan has made significant regulatory advancements by enhancing its compliance with Financial Action Task Force (FATF) standards for Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT). This effort has improved the country's reputation with international financial institutions and has been essential for facilitating secure cross-border transactions.

Digital payment adoption in Pakistan has great potential to simplify cross-border transactions; however, it faces numerous challenges that must be overcome. The country's digital infrastructure, both physical and regulatory, is still underdeveloped. Additionally, complex regulatory mechanisms pose a challenge, as strict CBDPs policies and compliance with AML standards slow down the process.

Moreover, limited integration of domestic payment platforms with global systems hinders seamless money transfers to other countries. An exacerbating issue is that Pakistan lacks established entities to collaborate with international financial platforms. A notable example of this challenge is PayPal, which ceased operations in Pakistan due to inadequate support and infrastructure to meet its operational requirements. Limited global integration with international payment systems such as PayPal, Stripe, and Google Pay restricts freelancers, e-commerce businesses, and IT service providers from receiving payments seamlessly.

Interoperability among different payment systems is also essential to operate CBDPs effectively. However, Pakistan's digital payment ecosystem remains fragmented, with limited interoperability between domestic and international payment systems. As the use of digital payments increases, the risks associated with cyber security also rise, presenting significant challenges to the security and reliability of CBDPs. It is essential to focus on managing the current account deficit. CBDPs should include policies and regulations facilitating payments from Pakistan to other countries. For instance, these systems should enable expatriates to receive investment returns through the Resident Foreign Currency Accounts and allow parents to cover their children’s expenses while studying abroad.

High transaction costs associated with traditional banking channels discourage individuals and businesses choosing CBDPs. Conventional remittance services typically charge 5-7% per transaction, making informal money transfer networks, such as Hawala and Hundi, more appealing. According to the World Bank's 2022 report, Pakistan's average remittance fee is 6.3%, significantly higher than the global average of 4.7%, further discouraging the use of formal digital channels.

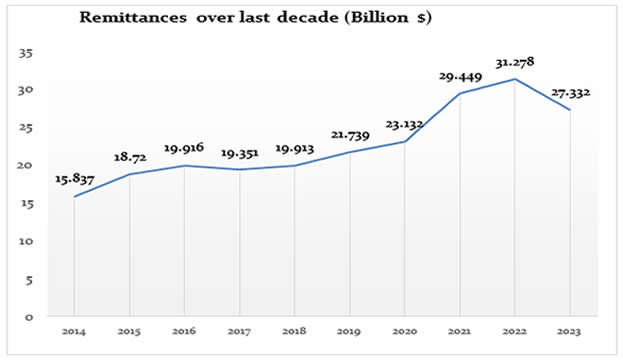

In 2022, a significant portion of remittances was funnelled into the Hundi market, reportedly due to the government's artificial cap on the dollar-to-rupee exchange rate. This situation led to the first decline in annual remittances since 2017, with a decrease observed in fiscal year 2023. Analysts and currency dealers attributed the US$4.25 billion drop in remittances in the previous fiscal year to the activities in the Hundi market, as illustrated in the graph.

Despite ongoing challenges, significant opportunities exist to transform Pakistan's payment ecosystem to facilitate CBDPs. Digitising remittance channels could significantly enhance the inflow of remittances. Additionally, collaborating with global fintech companies, such as China-based Alipay+, can provide innovative solutions tailored to Pakistan's unique financial landscape, creating new possibilities for individuals and businesses.

Furthermore, exploring blockchain technology could revolutionise CBDPs by offering cost-effective and efficient transactions while enhancing transaction speed and security. Reforming regulatory frameworks is essential for streamlining digital cross-border transactions while maintaining compliance with international standards. According to the IMF, Pakistan's regulatory framework for digital payments is still evolving, which has hindered the adoption of secure and interoperable payment systems.

Pakistan is at a crucial juncture. Embracing a strong digital infrastructure and a unified national strategy for capacity-building and development management offers the country a significant opportunity. This strategy should involve key stakeholders, including the State Bank of Pakistan (SBP), the Securities and Exchange Commission of Pakistan (SECP), the Ministry of Finance, the Establishment Division, banking and non-banking financial institutions, fintech companies, and law enforcement agencies.

CBDPs require the authorities' attention, both fiscally and monetarily. Addressing various aspects separately, such as regulations, financial inclusion, technological infrastructure, and international partnerships, may lead to fragmented efforts and unsatisfactory results.

Therefore, embracing a strong digital infrastructure and comprehensive national policy is needed to guide the implementation of cross-border payments, ensuring that all aspects are holistically integrated. This strategy would involve key stakeholders, including the SBP, the Securities and Exchange Commission of Pakistan (SECP), the Ministry of Finance, the Establishment Division, banking and non-banking financial institutions, fintech companies, and law enforcement agencies. Key stakeholders will only struggle to regulate CBDPs in Pakistan without an integrated national approach.

The views expressed in this Insight are of the author(s) alone and do not necessarily reflect the policy of ISSRA/NDU.