State broadcasters stand out for their non-commercial nature and mandate to promote national cohesion through information. Following this model, Pakistan Television Corporation (PTV) began in 1964 and later expanded its mandate to include information, education, and entertainment programmes. For over three decades, PTV held a monopoly on national airwaves with diverse and responsible programming. However, post-2000 media pluralism shifted viewer preferences and introduced strong competition from private and digital platforms. Therefore, this insight analyses PTV’s performance, vis-à-vis international peers and identifies challenges, based on expert opinion from seasoned media professionals.

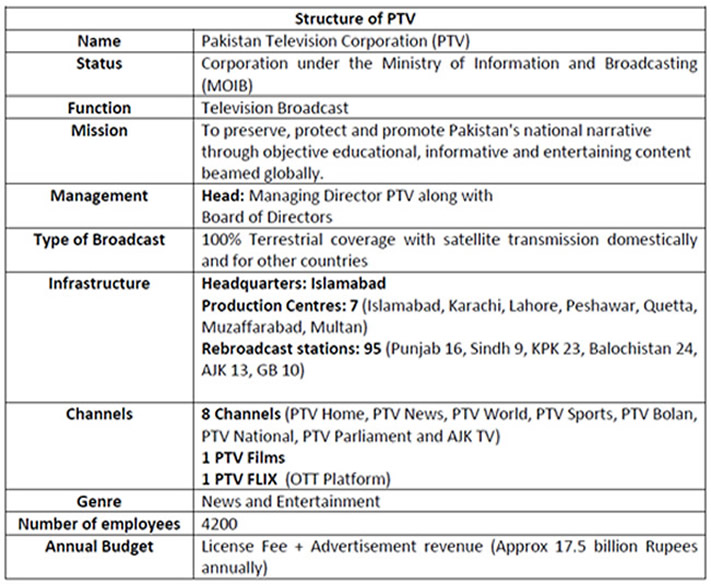

Table 1: Structure of PTV

Source: Extracted from Official Sources

Pakistan’s TV landscape includes satellite and terrestrial broadcasting. There are over 120 private satellite channels, and PTV leads terrestrial broadcasting with eight HD channels, reaching the country through seven production centres and 95 rebroadcast stations.

Managed by the Ministry of Information and Broadcasting (MOIB), PTV was primarily funded through a Rs35 license fee collected via electricity bills, generating around Rs10 billion annually, supplemented by fluctuating advertising revenue. However, collection was discontinued in June 2025.

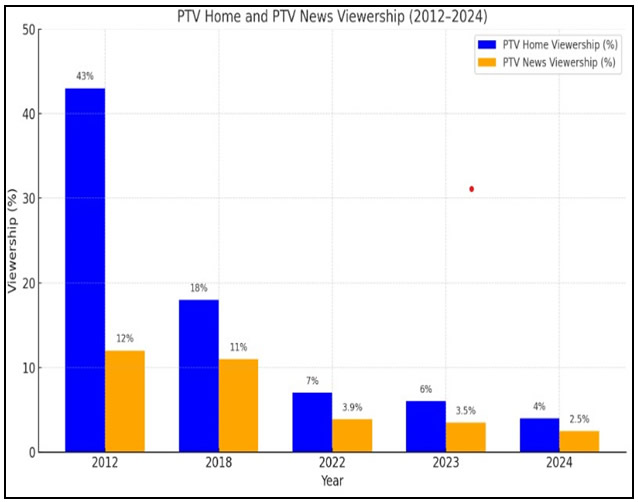

While PTV has a broad terrestrial and satellite footprint, it struggles to convert this reach into consistent audience engagement. In the 1990s, PTV held about 68% of total domestic TV viewership; however, (as illustrated in Graph 1), this dominance has eroded over time. Between 2012 and 2024, PTV Home’s audience share dropped from 43% to 4%, and PTV News declined by 75%.

Graph 1: PTV Viewership over 2 Decades

Source: Self Extracted form Data Centers

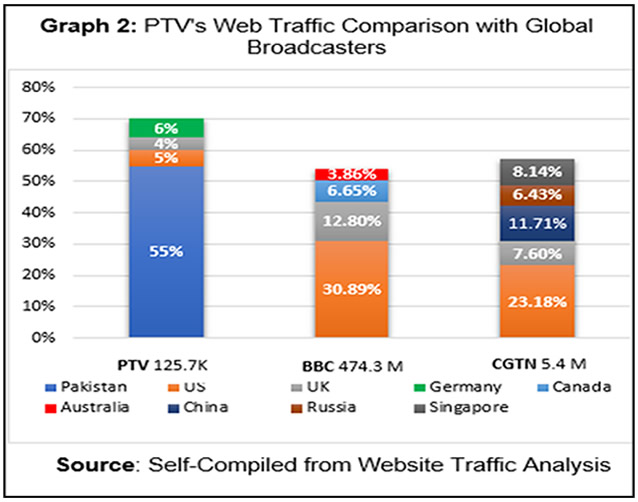

In terms of international reach, PTV World is broadcast in over 50 countries, compared to the British Broadcasting Corporation (BBC) in 200, Turkish Radio and Television Corporation (TRT) in 190, and China Global Television Network (CGTN) in 160. The website engagement analysis presents PTV as the least performing, with only 125,700 monthly visitors, 55% of whom are from Pakistan. In contrast, outlets like the BBC and CGTN receive far higher traffic, with less than 13% from the home country. This underscores PTV’s limited global reach and lack of internationally relevant content.

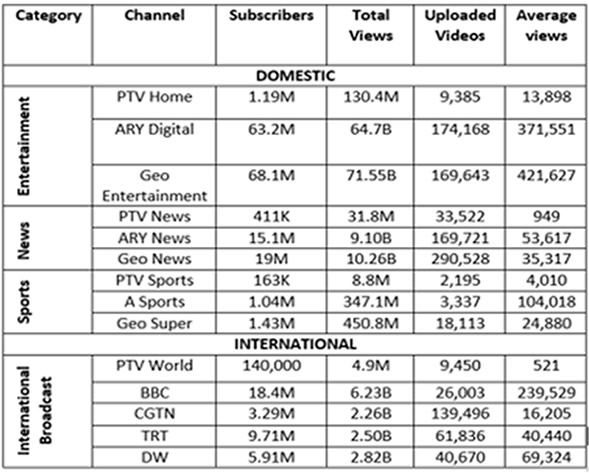

On YouTube, PTV shows very low audience engagement compared to both domestic and international competitors. Domestically, PTV is the lowest performing in the entertainment, news, and sports categories, while internationally, its digital presence remains nominal, in comparison to global broadcasters that often produce less content but achieve significantly higher viewership. For example, the BBC has uploaded only three times more content but gets about 461 times more views per video, averaging 239K views, while PTV receives just 519. Here, it is noteworthy that PTV treats its digital platforms primarily as archival repositories, whereas successful broadcasters curate special content for digital audiences.

In short, PTV’s performance has declined across both traditional and digital platforms. The challenge lies primarily in content quality, relevance, and ability to engage diverse audiences.

Table 2: Comparative Assessment of PTV vs Domestic and International Peers

Source: Self Extracted form YouTube Channels

As per experts, the key contributors to PTV’s decline are: gradual erosion of in-house production, restrictive editorial policies, and systemic inefficiencies.

Once known for producing impactful content in entertainment, PTV’s in-house entertainment production has now virtually ceased, reliant almost entirely on private production, except for live programming. At the same time, the high cost of privately produced dramas, averaging PKR 3 to 5 million per episode, remains well beyond PTV’s budget, forcing it to rely on outdated or low-quality content.

Secondly, in the news domain, PTV’s editorial policy is narrowly focused on government narratives, reflecting its institutional alignment with MOIB at the cost of editorial balance. In 2022–2023, PTV News aired 1,456 programmes on government activities, while coverage of other issues averaged only 300 each. Additionally, the absence of an independent editorial board exacerbates existing editorial imbalance and limits broader audience engagement.

Thirdly, broader public sector inefficiencies, such as bureaucratic delays and operational irregularities, have hampered PTV’s ability to respond to market changes. For instance, the launch of its OTT platform, PTVFLIX, in April 2023, although intended to monetise archival content, quickly stalled due to unclear mandates and a lack of strategic planning, thus turning into another loss-making venture.

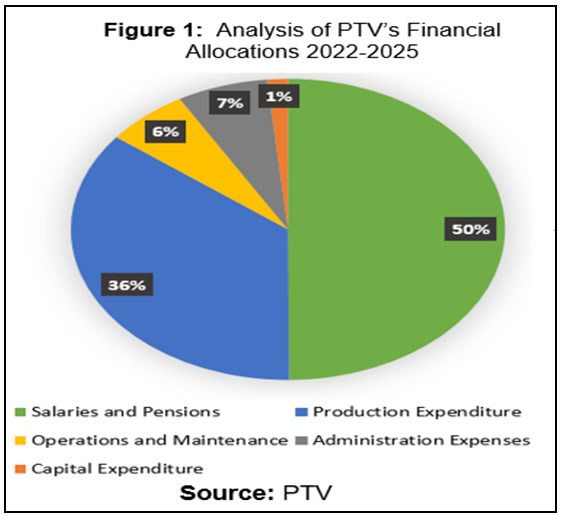

Central to PTV’s underperformance are deep financial imbalances. Over the past three years, it operated with an average annual budget of PKR 17 billion, nearly 50% of which is spent on salaries and pensions for over 4,200 employees, while just 35% was allocated to production and only 1.5% to infrastructure and technology. In contrast, the BBC spends only 18% on personnel and 51% on content production, reflecting a content-first strategy. This imbalance reflects misplaced priorities, where PTV is geared more toward sustaining the institution than producing quality content, thus hampering its competitiveness in the evolving media environment.

In light of the above discussion, it is evident that PTV needs to reform two major sections: Financial health and content development. To improve its finances, PTV needs to rationalize its workforce and allocate budgets more effectively, with a strong focus on production quality. Drawing on international models, broadcasters like the BBC, CGTN, and TRT use non-permanent contracts for technical staff to reduce long-term costs, a strategy PTV can adopt to improve sustainability. PTV should also explore private investment to support terrestrial operations under a clear implementation framework.

To improve content quality, PTV needs a comprehensive approach. In the entertainment sector, PTV must revamp its in-house production and upgrade equipment to meet modern standards. Joint ventures with private producers can serve as a practical starting point. TRT provides a strong example; its globally acclaimed drama Diriliş Ertuğrul, a co-production with private partners, showcases that high-quality, audience-relevant content can boost both domestic viewership and international reach. For PTV, adopting a similar model could be key to restoring its entertainment relevance and appeal.

In the news domain, with declining viewership, restoring public trust in PTV’s news content is critical. A balanced editorial model, combining the BBC’s independent board structure with TRT’s strategic alignment to national priorities, offers a practical path forward. By ensuring editorial autonomy through an empowered board, PTV can enhance its credibility while fulfilling its public service role.

In terms of digital engagement, globally, broadcasters like BBC, TRT, and CGTN have adopted a digital-first approach, using strong multi-platform strategies and mobile-friendly content, curated for online audience. PTV can follow this model to revamp its digital strategy and expand its outreach.

In conclusion, in an era of growing misinformation and fragmented media spaces, the role of credible public broadcasters has become more critical than ever. PTV, with its historic status, diverse mandate, and national reach, is well-positioned to serve this role. However, its viewership across traditional and digital platforms is on a decline, but it isn’t irreversible. International models from BBC, TRT, and CGTN present a workable foundation for revival. Therefore, it is high time for PTV to reclaim its place as the state broadcaster.

The views expressed in this Insight are of the author(s) alone and do not necessarily reflect the policy of ISSRA/NDU.