Established in the 1970s, the petrodollar system ties the value of global oil sales to the US dollar, creating a unique relationship between oil-exporting nations and the international economy. As one of the world's largest oil exporters, the Kingdom of Saudi Arabia (KSA) has played a pivotal role in maintaining this system, benefiting from vast oil revenues that have fueled rapid modernisation, extensive infrastructure projects, and international investments. Over the decades, this oil-backed economic model shaped not only KSA’s domestic trajectory but also its geopolitical alliances. This insight examines KSA’s strategic realignment from a Petro-dollar-driven economy to a diversified, technology-oriented powerhouse, significantly impacting global energy markets and regional partnerships.

The longstanding petrodollar agreement, signed between the KSA and the US on June 8, 1974, ensured that oil sales were exclusively denominated in dollars, securing political and military support while solidifying its economic influence. However, in 2024, KSA terminated this deal to diversify its economy and partnerships, including trade with China and its BRICS membership, signaling a shift toward a multipolar economic order. This transformation is not merely economic, but also reflects a broader vision of national reinvention underpinned by Vision 2030, where innovation, digital infrastructure, and non-oil sectors are key to becoming central to long-term sustainability.

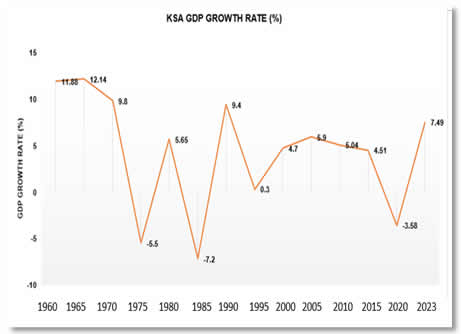

Graph 1

Source: Self-Compiled by the Author with the Data from the World Bank

Several factors have contributed to KSA’s move toward economic diversification, including volatile oil prices, growing environmental concerns, and the global shift toward renewable energy sources, which has made KSA’s reliance on oil a point of vulnerability. As Graph 1 illustrates, KSA’s GDP growth trend reflects significant economic volatility, characterised by fluctuations over the decades. The country experienced rapid economic growth in the late 1960s, driven by an oil boom that significantly increased revenues.

After 1970, the economy began to decline primarily due to the Arab members of the Organization of the Petroleum Exporting Countries (OPEC) imposing an embargo, cutting off exports to countries supporting Israel, which caused a global oil shortage and a sharp rise in prices. However, by 1975, GDP growth had dipped sharply and reached its lowest level, as global demand rose, but the country struggled to manage the economic pressures of its rapidly expanding oil wealth. Then, in 1985, the collapse of international oil prices led to another abrupt contraction. This vulnerability became even more evident during the 2020 COVID-19 pandemic, which resulted in a 6.8% economic contraction, as recorded by the International Monetary Fund (IMF), due to a global collapse in oil demand and prices.

In addition to economic shocks, several strategic and structural imperatives have driven KSA’s realignment. The rise of global climate change discourse and pressure to reduce carbon emissions has put traditional oil-exporting economies under increasing scrutiny.

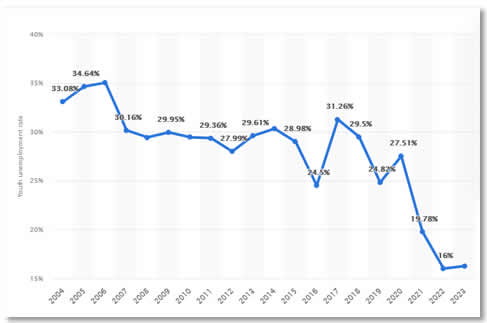

Another major factor behind KSA’s push to diversify its economy away from oil is the persistent challenge of youth unemployment. In the early 2000s, unemployment among young Saudis remained alarmingly high, highlighting deep-rooted structural issues within the labour market and the limitations of an oil-dependent economic model. As shown in Graph 2, the youth unemployment rate peaked at 34.64% in 2006 and remained stable in the subsequent years.

Graph 2

Source: Self-Compiled by Author with the Data from Statista (2024)

In response to this long-standing issue, Vision 2030, introduced in 2016 under Crown Prince Mohammed bin Salman (MBS), aimed to reduce the Kingdom's reliance on oil and address socioeconomic challenges, including youth unemployment. The strategy focused on developing non-oil sectors such as technology, tourism, and digital services, which were better positioned to absorb the young workforce. The plan was structured around three main pillars: cultivating a vibrant society, building a thriving economy, and establishing an ambitious nation.

KSA’s strategic realignment emphasises technology and innovation through massive digital infrastructure investments and landmark initiatives, such as the $500 billion Neom project, which is supported by partnerships with global tech giants. These partnerships drive advancements in cloud computing, cybersecurity, and AI. This transformation has also elevated KSA’s international standing, enabling it to shape the key agenda on sustainability and digital governance through its active participation in platforms such as the G20 and BRICS+. At the same time, its Public Investment Fund emerges as a powerful player in international markets.

Efforts to build a tech-savvy workforce are equally significant. The Kingdom invests in educational reforms, establishing R&D centres, and fostering local startups to nurture innovation and entrepreneurship. These initiatives aim to reduce dependence on foreign expertise and cultivate a self-sufficient technological ecosystem. As a result of these diversification efforts, recent years have seen a notable decline in youth unemployment, which fell to 19.78% in 2021 and reached a historic low of 16% in 2023, as shown in Graph 2. Moreover, by 2022, Saudi Arabia ranked among the top 10 countries globally in digital competitiveness indices, signaling the rapid progress of its transformation. This shift highlights Vision 2030's effectiveness in transforming the economic landscape and aligning the Kingdom’s workforce development with the aspirations and potential of its youth.

KSA’s exit from the exclusive petrodollar framework and growing trade and investment ties with BRICS nations reflect a deliberate shift toward a multipolar world. By aligning with emerging economic blocks, the Kingdom diversifies its geopolitical alliances, reduces overdependence on the West, and seeks greater strategic autonomy. This rebalancing is reshaping traditional power dynamics in the Gulf and weakening the once unquestioned dominance of US influence in the region.

The Saudi-Iran rapprochement, helped by China in March 2023 after seven years of severed ties, marks a significant shift in the regional landscape and underscores KSA’s strategic pivot toward stability and pragmatic diplomacy. By regularising relations with Tehran, KSA reduces the risk of regional confrontation, creating space to focus on internal reforms and Vision 2030 goals.

Furthermore, KSA has prioritised cultural advancement as a key pillar of its Vision 2030 agenda, promoting arts, cinema, music, and heritage preservation to reshape its global image and empower its youth. Alongside this cultural revival, the Kingdom has made significant investments in sports, established a dedicated Ministry of Sports in 2018, and hosted high-profile events, including the FIFA Club World Cup in 2023. Saudi Arabia will host the FIFA World Cup in 2034, marking a significant milestone in its soft power and global engagement strategy.

As KSA focuses on modernisation and soft power, Pakistan can strengthen bilateral ties, collaborate on regional stability, and position itself as a strategic partner in the Gulf’s evolving geopolitical and economic landscape.

The views expressed in this Insight are of the author(s) alone and do not necessarily reflect the policy of ISSRA/NDU.